Embrace the feeling of freedom that comes with owning a freehold property. Yet, this sense of liberation can be easily overwhelmed by the intricacies of the conveyancing process. That’s where understanding freehold conveyancing becomes crucial. This comprehensive guide, aptly titled ‘Freehold Conveyancing Quotes: Get Transparent Costs for Your Property Transaction’, is designed to help homeowners and property buyers navigate this complex terrain with ease and confidence.

In the world of real estate, freehold conveyancing refers to the legal and administrative process of transferring ownership of a freehold property from one person to another. Freehold properties are those where the owner has full control over both the land and the building on it, without any time limit on ownership. This type of property is the most common form of ownership in the UK housing market.

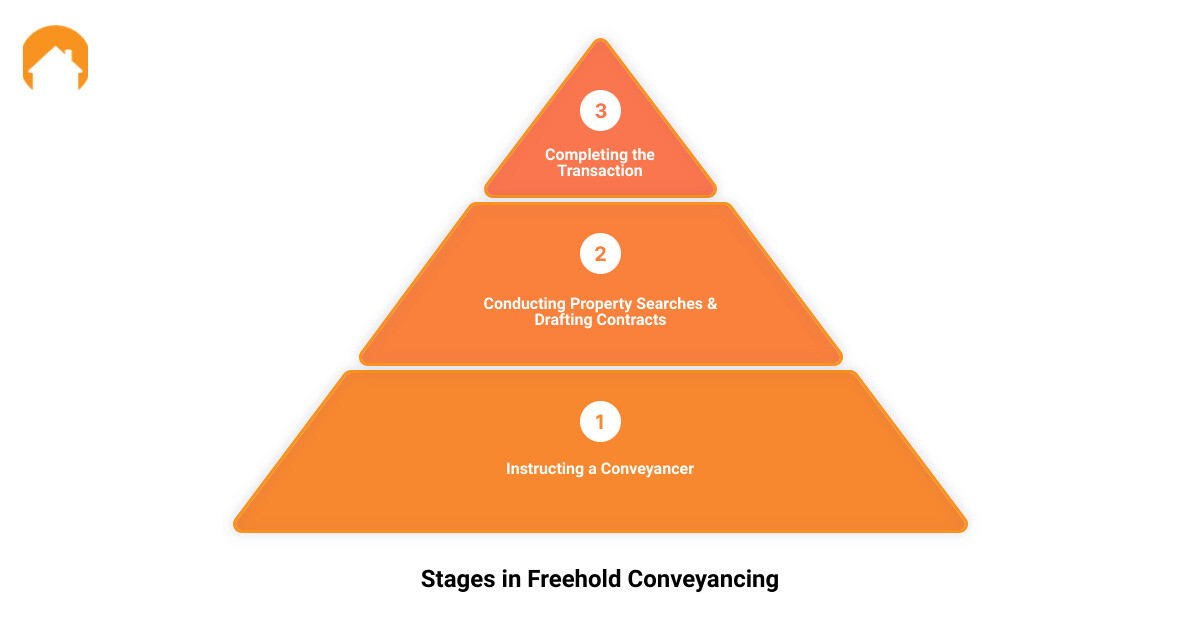

While the idea of owning a property outright is certainly exciting, the legal procedures involved in freehold conveyancing can be daunting, especially for first-time buyers. This process involves a series of steps, including instructing a conveyancer, conducting property searches, drafting and exchanging contracts, and completing the transaction. But fear not, this guide is here to simplify these steps, explain the costs involved, and highlight the importance of obtaining accurate and transparent freehold conveyancing quotes.

Stay tuned as we delve into the details of freehold conveyancing, empowering you to make informed decisions and ensure a smooth property transaction. Your journey to understanding freehold conveyancing begins now!

Understanding Freehold Conveyancing Quotes

If you’re contemplating a property transaction, whether buying or selling, you’ve probably come across the term “conveyancing quote“. But what does it truly entail? Understanding freehold conveyancing quotes is a vital step towards ensuring a seamless property transaction.

What is a Conveyancing Quote?

A conveyancing quote, in simple terms, is an estimate of the legal costs you’ll incur during a property transaction. It’s a preliminary financial map, outlining the expected expenses to facilitate the legal transfer of property from one party to another. These quotes include legal fees, disbursements, and, when necessary, any additional costs associated with your specific case.

While fixed fee quotes offer a predetermined price for the whole process, hourly rate quotes depend on the amount of time a solicitor or licensed conveyancer spends on your case. Understanding these differences can guide you in making an informed decision when comparing quotes.

Factors Influencing Freehold Conveyancing Quotes

Several factors can sway the final figure on your conveyancing quote. Primarily, the property value plays a significant role, with higher-priced properties often attracting higher legal costs. The geographical location of the property can also influence the quote, with properties in major metropolitan or conservation areas usually incurring higher fees.

Furthermore, the scope of additional services or searches requested by the buyer can impact the overall conveyancing quote. These could include bespoke surveys or specific local searches, for instance. Acknowledging these factors will equip you to better anticipate and manage the costs tied to your freehold property purchase.

Importance of Accurate and Transparent Quotes

The path to a successful property transaction is paved with accurate and transparent quotes. An accurate quote allows you to budget effectively, ensuring that you’re aware of potential costs upfront. Transparent quotes, on the other hand, help you identify and sidestep any hidden fees or charges that might emerge during the conveyancing process.

To secure a clear, accurate quote, consider obtaining multiple quotes for comparison, request a detailed breakdown of the quote to identify any extra costs, and choose a trusted, licensed conveyancer. Remember, the goal is to navigate your freehold property transaction with full financial awareness and no surprises.

In the next section, we’ll guide you through the process of freehold conveyancing, breaking down each step to provide a clear understanding of what to expect. So, let’s journey forward and unravel the intricacies of freehold conveyancing!

The Process of Freehold Conveyancing

Just like a well-rehearsed symphony, the process of freehold conveyancing unfolds in a series of orchestrated steps, each one crucial to the harmonious conclusion of a property transaction. Let’s take a closer look at these key stages.

Instructing a Conveyancer

The opening act in the freehold conveyancing performance is instructing a conveyancer. This legal professional is your guide through the maze of property law, coordinating with sellers, drafting contracts, and liaising with mortgage companies. Choosing a licensed and experienced conveyancer is paramount to ensure a smooth and hassle-free process. They will be in charge of researching property details and ensuring that all legal aspects of the property transfer are handled with precision and care.

Conducting Property Searches

The next phase of the freehold conveyancing process involves comprehensive property searches and due diligence. Your conveyancer will conduct a series of searches and enquiries to uncover crucial information about the property. This can include checking for any restrictive covenants, confirming the legal boundaries, and investigating local planning matters. These thorough searches are akin to shining a flashlight into the hidden corners of a property’s history and future potential, ensuring there are no unpleasant surprises down the line.

Drafting and Exchanging Contracts

Once the curtain falls on the searches and enquiries, your conveyancer takes on the role of a skilled composer, drafting a contract that harmonises all the terms and conditions of the property purchase. This contract, once approved and signed by both sides, is exchanged – a significant moment in our freehold conveyancing symphony. This exchange of contracts legally binds both parties to the sale, turning a tentative agreement into a firm commitment.

Completing the Transaction

The final act in the freehold conveyancing process is the completion stage. On completion day, the buyer’s conveyancer transfers the remaining funds to the seller’s side, and the buyer takes possession of the property. Finally, the conveyancer submits any tax returns, such as the Stamp Duty Land Tax, and registers the change of ownership with the Land Registry. This final stage culminates in a satisfying crescendo, with the keys to your new home firmly in your hands.

Understanding these steps is essential for a smooth and successful freehold conveyancing process. With the right guidance from a trusted conveyancer, you can navigate this process effectively, ensuring you strike the right chords at every stage of your property transaction.

Costs Associated with Freehold Conveyancing

In the world of property transactions, understanding the costs associated with freehold conveyancing is critical to ensure a successful and cost-effective process. These costs range from legal fees and disbursements to specific charges like electronic money transfer fees and Land Registry fees. Let’s delve into what each of these costs entails.

Legal Fees and Disbursements

When it comes to the sale of a freehold residential property, the conveyancer’s legal fees typically range between £1,000 and £1,750. This fee depends on several factors, including the value and location of the property and the complexity of the case. Moreover, this fee assumes a standard transaction with no unforeseen matters that require additional work or delay the process, such as defects in title.

Disbursements are costs related to your property transaction payable to third parties, such as Land Registry fees. Your conveyancer handles these payments on your behalf to ensure a smoother process.

Electronic Money Transfer Fee

An often overlooked cost in freehold conveyancing is the electronic money transfer fee. This fee is charged for transferring money electronically, such as paying off a mortgage or sending the purchase funds to the seller’s solicitor. The typical electronic money transfer fee is £36.

Land Registry Fees

Another key cost in freehold conveyancing is the Land Registry fee. When selling a property, you will need to provide the buyer with an official copy of the title register, which costs £6. This document contains the details of the property and the ownership.

Case Study: Cost Breakdown for a £200,000 Freehold Property

To put these costs into perspective, let’s consider a case study. If you’re selling a freehold property valued at £200,000, the typical cost breakdown would be as follows:

- Legal fees plus VAT: £1,000

- Electronic Money Transfer Fee: £36

- Land Registry Title Deeds: £6

- Total including VAT: £1,042

Keep in mind that these are just estimates, and the actual costs can vary based on various factors. However, this example gives you a good idea of what you can expect to pay during the freehold conveyancing process.

Remember, transparency in costs is crucial when it comes to freehold conveyancing. By understanding these costs upfront, you can plan your budget accordingly and avoid any unexpected surprises along the way.

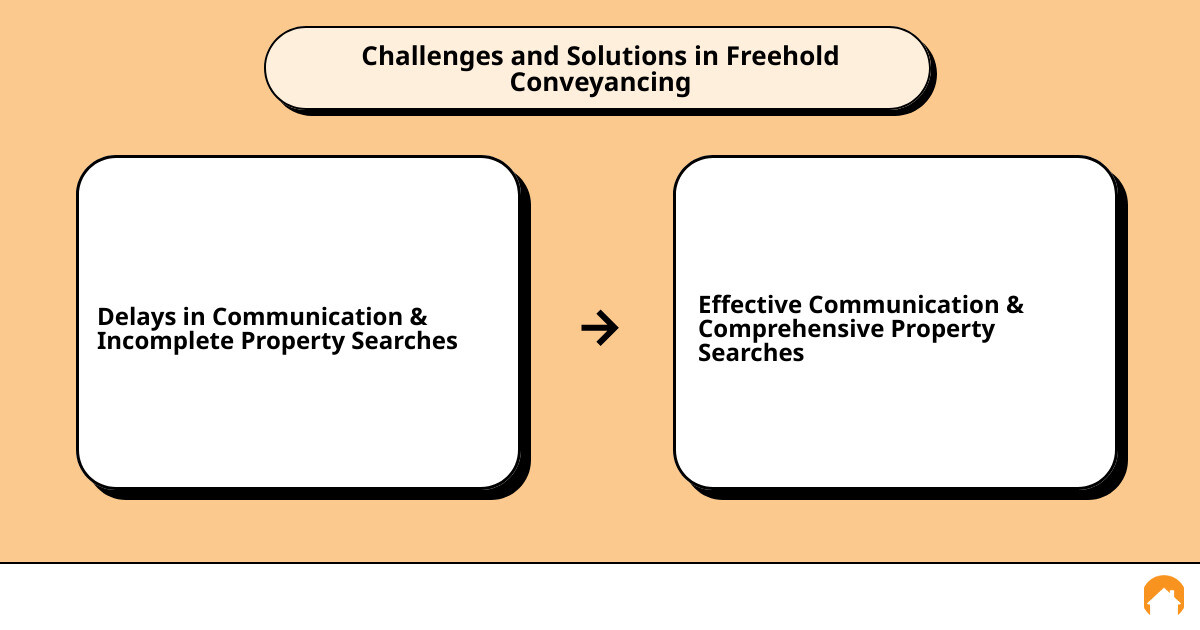

Challenges in Freehold Conveyancing and How to Overcome Them

Navigating the path of freehold conveyancing can sometimes feel like traversing a labyrinth. Despite the simplification that comes with owning a freehold property, challenges and complexities can arise, causing delays and frustration. However, being well-informed can equip you to handle these effectively. Here are some common challenges you might encounter and how to overcome them:

Delays in Communication

Ah, the dreaded communication delays. This can often be a major stumbling block in the freehold conveyancing process, causing unnecessary delays and confusion. These delays might occur due to overworked solicitors, slow responses from authorities, or even uncooperative sellers or buyers.

The key to overcoming this challenge is to engage a responsive and proactive conveyancer. Make sure they are committed to maintaining open lines of communication and providing regular updates on the progress of the transaction. Don’t hesitate to put a little pressure on your solicitor to get answers if things are taking too long. After all, you’re the one purchasing the property!

Incomplete Property Searches

An incomplete or inadequate property search is another common challenge that can lead to complications later on. From overlooking restrictive covenants to missing crucial local planning matters, these oversights can be costly.

To mitigate this risk, ensure your conveyancer is committed to conducting thorough searches and surveys. They should take the time to explain any findings and answer any questions you may have. Remember, understanding the ins and outs of your potential property is not just important – it’s essential.

Last-Minute Obstacles

Last-minute surprises are the last thing you want when you’re on the brink of completing a property transaction. These surprises can range from discrepancies in contracts to complications with your mortgage.

To tackle these inevitable obstacles, work with an experienced and diligent conveyancer. They can help you address potential issues proactively, ensuring you don’t lose momentum in the conveyancing process. Bear in mind that complex transactions may take longer and your conveyancer’s main goal is to protect you during the entire transaction.

Conquering these common challenges in freehold conveyancing requires a blend of knowledge, preparation, and professional support. By being well-informed and choosing a trusted conveyancer, you’ll be well-equipped to navigate any hurdles that come your way on the path to homeownership.

How My Conveyancing Specialist Can Help

Tackling freehold conveyancing can be daunting, but with the right support, you can navigate this process seamlessly. My Conveyancing Specialist is your one-stop solution for all your conveyancing needs, offering a range of tailored and transparent services to help you manage your property transaction smoothly.

Tailored and Transparent Conveyancing Services

Every property transaction is unique, and a one-size-fits-all approach can lead to complications and unexpected costs. My Conveyancing Specialist offers tailored conveyancing services that are designed to cater to your specific needs. Our team of legal professionals ensures that you receive a service that fits your property transaction requirements perfectly, eliminating any hidden costs and surprises.

Instant Quotes and Booking a Call with a Conveyancer

In the digital age, waiting for a quote or an appointment can be frustrating. My Conveyancing Specialist understands this and offers instant freehold conveyancing quotes, saving you both time and money. You can compare costs and book a call from your chosen conveyancer, ensuring that your transaction progresses without unnecessary delays.

Comprehensive Fee Pricing for Different Types of Buyers and Sellers

Whether you’re a first-time buyer, a residential property buyer/seller, or an investor, My Conveyancing Specialist has a comprehensive fee pricing structure tailored to suit your needs. We believe in providing a competitive conveyancing quote without compromising on the quality of service, giving you the best value for your money.

SRA Regulated Conveyancing Solicitors and CLC Licensed Conveyancers

Trust and expertise are critical when dealing with property transactions. My Conveyancing Specialist is proud to work with a nationwide panel of SRA regulated conveyancing solicitors and CLC licensed conveyancers. Our legal professionals adhere to the highest standards of service, offering you peace of mind throughout your property transaction.

Wide Range of Areas Covered for Conveyancing Quotes

Location should not be a barrier when it comes to receiving excellent conveyancing services. My Conveyancing Specialist provides nationwide coverage, catering to clients across England and Wales. Whether you’re based in a bustling city or a quiet rural area, you can count on us to deliver exceptional service and support.

In the world of property transactions, My Conveyancing Specialist is the trusted partner you need. With our transparent costs, tailored services, and a team of dedicated professionals, we can streamline your freehold conveyancing process, ensuring a smooth and successful property transaction.

Conclusion: Simplifying Your Freehold Conveyancing Process with My Conveyancing Specialist

With the whirlwind of tasks and responsibilities involved in purchasing a freehold property, it’s easy to feel overwhelmed. However, My Conveyancing Specialist strives to simplify this complex process, making it easier for you to navigate the intricacies of freehold conveyancing with confidence and ease.

Our team of experienced conveyancers and solicitors are dedicated to providing you with transparent, comprehensive, and tailored services. We take the time to understand your unique property needs and deliver customised solutions that align with your expectations and financial capabilities. We believe in the power of clarity, ensuring that our freehold conveyancing quotes are not only accurate but also easy to understand, with no hidden fees or charges.

Moreover, My Conveyancing Specialist embraces the power of technology to provide instant quotes and facilitate seamless communication between you and our team. Our online platform allows you to obtain a conveyancing quote in under 30 seconds, saving you valuable time and effort in your property transaction journey.

As SRA-regulated solicitors and CLC licensed conveyancers, we uphold the highest standards of professional conduct and service. We cover a wide range of areas for conveyancing quotes, ensuring that wherever you are in the UK, we can assist with your property transaction needs.

In conclusion, MyConveyancingSpecialist is your go-to partner for a hassle-free freehold conveyancing process. We are committed to delivering superior service, ensuring your property transaction is handled with the utmost care and expertise. With My Conveyancing Specialist, you can have peace of mind knowing that your dream of owning a freehold property is in trustworthy, capable hands.